When I hear “data-driven”…

This week we look at good investments and how the best ideas don't always work out.

<<Support my work: book a keynote or briefing!>>

Want to support my work but don't need a keynote from a mad scientist? Become a paid subscriber to this newsletter and recommend to friends!

Research Roundup

Good Ideas Don't Always Work

Translating research findings and well-intentioned policies into real-world impact requires more than good intentions and “data”. Unexpected consequences and perverse incentives can hinder progress.

Take, for example, Indonesia’s admirable plan to “grant community titles for 12.7 million hectares of land to communities living in and around forests”. The idea is to protect these old growth forests against deforestation by giving the local communities the power. Unfortunately, “community titles aimed at conservation did not decrease deforestation; if anything, they tended to increase forest loss”. Apparently it didn’t occur to anyone to wonder if those local communities valued cash today over forests tomorrow.

One of the problems in designing good policy is that policy makers are not neutral parties. They often have huge personal investments in specific policies, from personal reputations and dedicated budgets. When scientific evidence is available to guide urban policy (e.g. the language used in nudge-based messages) “strength of the evidence [does]not strongly predict adoption”. Instead, “the largest predictor is whether” evidence supports using the pre-existing policy.

There is one positive note, however: changes to “preexisting [policies] are more naturally folded into” future plans. Policy-makers can adapt…a nudge.

So, whenever someone brags to me about being a “data-driven” business, I just hear, “We use data to justify what we’d already decided to do.”

Selling Debt

Rentier: “a person living on income from property or investments”. Rather than live off of sharecropping or stock dividends, the modern rentier buys consumer debt.

Over the past 40 years, “Americans in the top 1% of the income or wealth distribution” have seen a huge relative gain in savings compared to the rest of society. This isn’t inherently problematic if these savings funded productive investment, but people like me “have accumulated substantial financial assets that are direct claims on U.S. government and household debt”.

A tangible example of this unproductive rentier behavior comes from credit cards. “Reward cards induce more spending” but “naive consumers repay credit cards following a sub-optimal balance-matching heuristic and incur higher costs”. The net result is “$15 billion” transferred “from less to more educated, poorer to richer, and high to low minority areas”. That transfer is funneled back into more naive debt.

In the spirit of “tax the things you don’t want”, taxing “stupidity” would be a great policy…if we had reason to believe that it would decrease the supply. Capitalism’s best pitch is that it lifts productivity and floats all boats—investing in naive debt leaves little but drought.

Weekly Indulgence

Mad Science Solves is back!

Join us Tuesday, August 27 @ 11am PST

Come ask me anything… Grab your ticket here!

Stage & Screen

- August 14-15 Napa: Mandrake Capital Partners

- August 23, virtual: more fun with BCG 😄

- September 8, Athens: ESOMAR

- September 25, SF: BCG Australia

- September 26, Wyoming: Tetons Leadership Counsel

- September 27, NYC: well...the teaser is right above this.

Upcoming this Fall (tentative)

- October 1-4, Singapore: Hyper Island and more! (Book me!!!)

- October 9-10, NYC: 2 events in one–I'm back at the UN speaking at GlobalMindED and then receiving StartOut's Trailblazer Award

- October 23, Toronto: Let's spend the day together at Metropolitan University's Future of Work conference

- October 28-19, Rome: Are you as shocked as I that this is my first ever visit to Italy? I'll be talking AI and Humans for the UN.

Find more upcoming talks, interviews, and other events on my Events Page.

If your company, university, or conference just happen to be in one of the above locations and want the "best keynote I've ever heard" (shockingly spoken by multiple audiences last year)?

SciFi, Fantasy, & Me

Well this was unexpected, nonfiction fun: The Future Was Now. Its the story of how and why a cluster genre movies—E.T., Poltergeist, Blade Runner, Tron, The Wrath of Khan, Conan the Barbarian, The Road Warrior, and The Thing—were all released within 2 months of each other in the summer of ‘82…a summer I very much remember. (I was actually watching “Space Seed” when I first saw an ad for Wrath of Khan.) If you are at all curious about why we live in a world of special effect laden summer blockbusters, I highly recommend it. (Bonus: did you know ET and Poltergeist started out as one movie concept?)

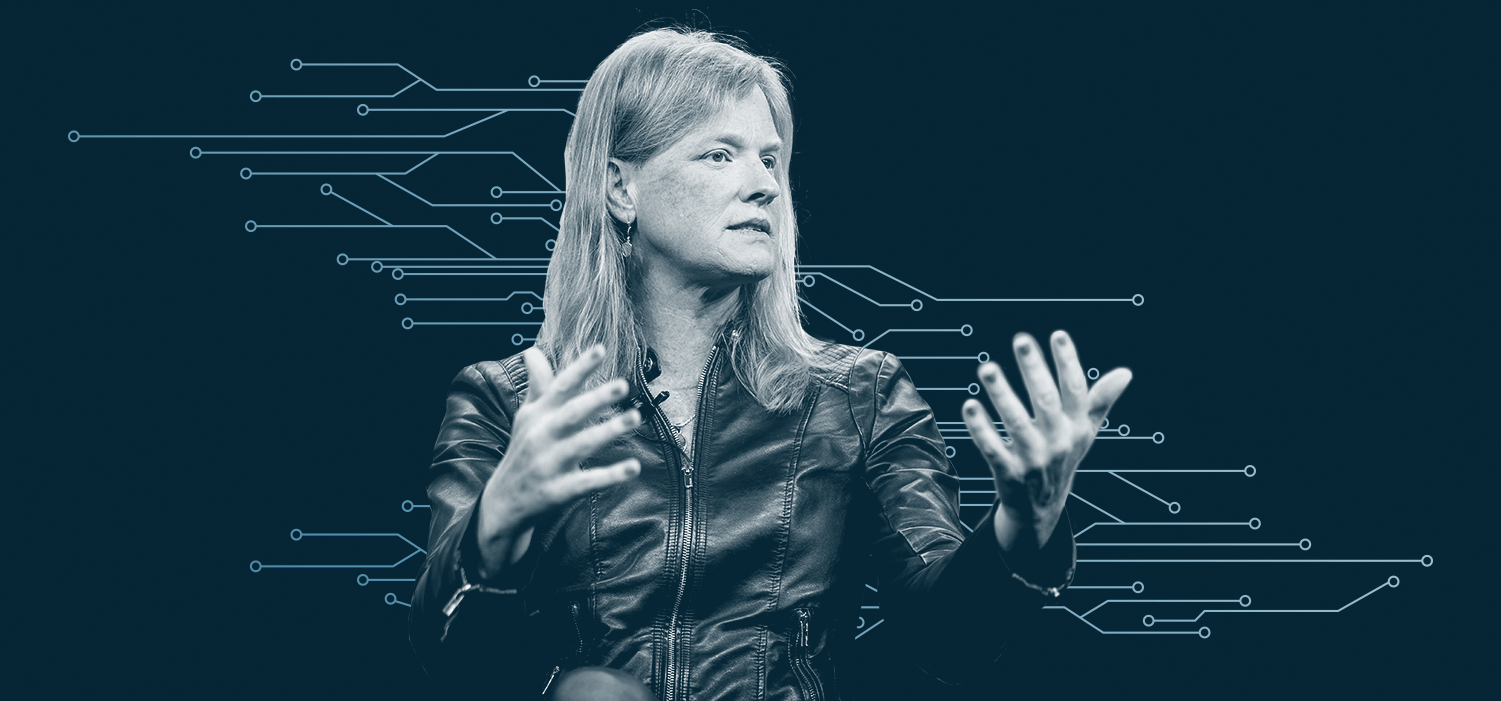

Vivienne L'Ecuyer Ming

| Follow more of my work at | |

|---|---|

| Socos Labs | The Human Trust |

| Dionysus Health | Optoceutics |

| RFK Human Rights | UCL Business School of Global Health |

| Crisis Venture Studios | Inclusion Impact Index |

| Neurotech Collider Hub at UC Berkeley | GenderCool |